In our modern world, there are endless alternatives. Therefore, it’s difficult to choose an opportunity that is right for you. Have you ever found yourself wondering whether you should quit or stay in your job, accept an offer or give it up for another, or purchase or survive without? Do you know the cost or opportunity you can gain when you choose one from another other?

There is a simple and practical method that solves this problem. It’s about finding out the opportunity cost. When you understand opportunity cost, you have the power to measure every alternative with precision and make the right decisions.

What is Opportunity Cost?

In the field of economics, opportunity cost is the value that you have to forgo when you choose an option over another good option. It is a concept you can apply in many situations, from deciding which projects you should pursue to spending time with loved ones instead of working overtime. Most people overlook opportunity costs because the benefits are usually hidden from view.

One of the key principles of economics is there is no such thing as free lunch or something for nothing. The resources that you have – time, autonomy, and money are scarce.[1] Choosing one will require you to forego lots of amazing opportunities.

Every alternative has a unique set of pros and cons. The simplest examples involve your daily purchases. Since you cannot buy everything you need, you tend to compare products, the amount of money you’ll pay, and the number of goods that you’ll get.

To boost your productivity and efficiency in decision making, you have to have priorities. Every time you choose something, you forgo other alternatives together with their benefits. The true cost of something is what you’ll have to give up to get.

Why You Should Care About Opportunity Cost

When economists look at opportunity cost, they consider two types:

- Explicit – These are costs that are incurred when you take a specific course of action. These costs are usually associated with a decision. And they include wages, stock purchases, utilities, and rent to name a few. Any amount that is required to move due to a decision falls under this category.

- Implicit – These are costs that you may or may not incur by forgoing a course of action. They are difficult to identify because they are indirect. They represent benefits or income that you could have generated had you gone for the alternative choice.

Opportunity cost matters not only in economics but also in real life. It is what you are giving up to get something. For instance, by choosing to buy a particular brand, you lose the opportunity to buy and try all other substitutes.

Another huge dilemma that affects a lot of people is choosing to start a business or advance their careers. At first, the cost of starting a new business can make you think twice about following this path. Yet, starting a business comes with lots of opportunities. On the other hand, advancing your career can enable you to develop new skills and get ahead in life. However, you’ll easily notice that entrepreneurs tend to achieve more of what they want than those who are employed.

If you choose to start a business, you’ll have a harder time compared to those who choose to advance their careers. However, in the long term, you’ll achieve your goals. Analyzing such situations will help you understand the concept of opportunity cost and make the best decision without much effort.

How Opportunity Cost Relates to the Production Possibilities Curve

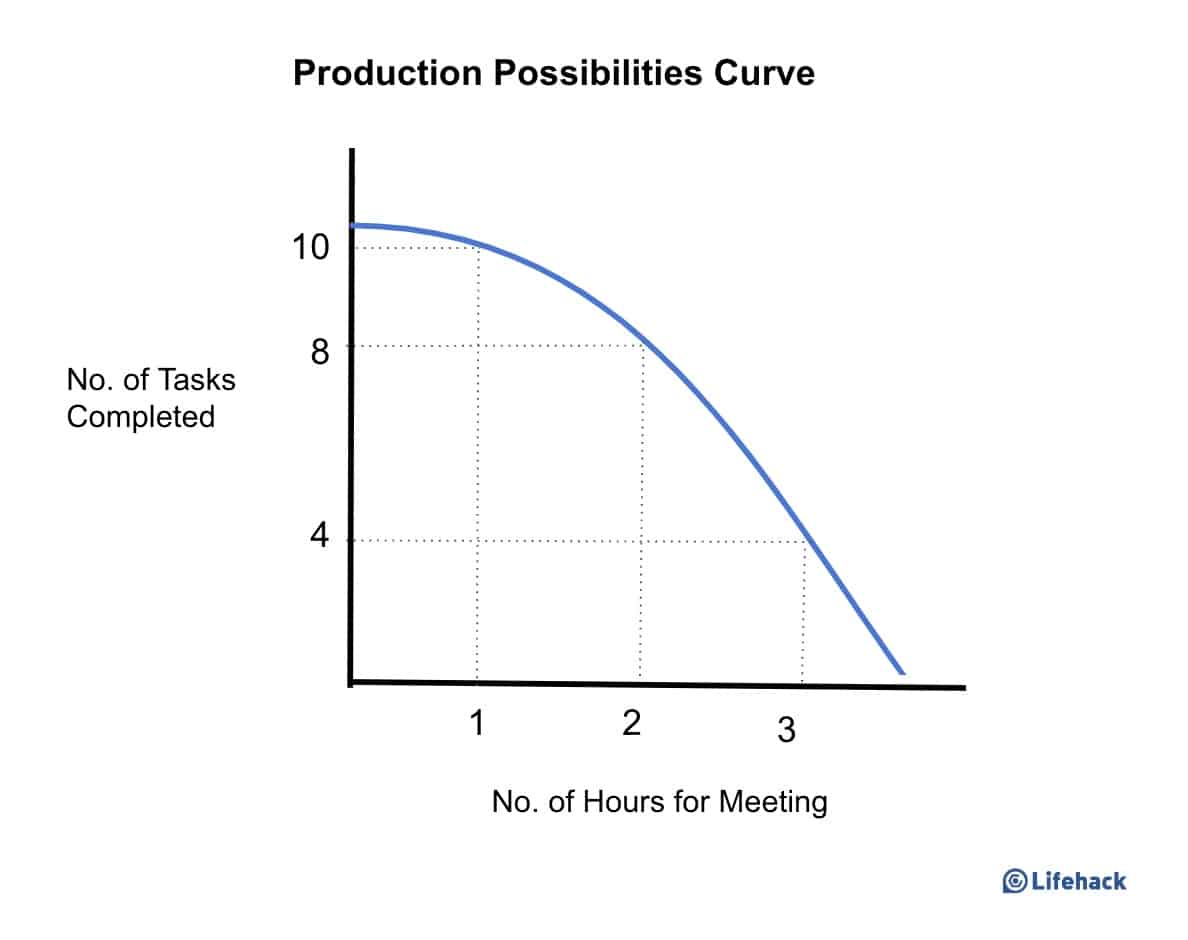

The Production Possibilities Curve is a model that demonstrates the tradeoffs linked to allocating resources between the production of two commodities.[2] The Production Possibilities Curve clearly illustrates the concepts of scarcity, opportunity cost, efficiency, and contractions.

For instance, say a manager splits her work hours between meetings and completing her tasks. This Production Possibilities Curve would show her productivity rate using the available resources:

If she uses 3 hours for meetings, she can only do 4 tasks. However, if she gives up 2 hours of meeting time, she can complete 10 tasks. The 2 hours she gives up for meeting make room for completing more tasks – that is the opportunity cost.

You should keep in mind that not every cost is monetary. Opportunity cost is usually expressed in terms of how much a product, service, or activity must be forgone to produce a good or pursue an activity. For instance, if you decide to buy a new phone, the cost of this activity isn’t just what you’ll pay for but the value of the forgone alternative, such as signing up for a self-improvement course.

Examples of Opportunity Cost

You cannot have everything you want in life. Your unlimited wants will always be confronted by a limited supply of time, services, money, goods, and opportunities. Scarcity forces us to make choices, and by extension incur costs and forgo alternatives. Here are five simple opportunity cost examples:

- Your boss gives you $600 as a thank you gift. You can either go for a vacation or attend a seminar to develop new skills. You choose to attend the seminar. In this situation, the opportunity cost is the vacation.

- You have been saving money for ten years now. When you check your account, you realize that you have $10,000. You want to invest the money to get better returns. You have to choose between depositing it in a bank to earn interest or investing in yourself to increase your productivity at work. Choosing the stock market will allow you to multiply your money faster. However, your opportunity cost is the development of important skills that would help you move forward in different aspects of your life.

How to Calculate Opportunity Cost (Step-by-Step)

To solve math problems, you need to use formulas. While calculating opportunity cost might seem like a math problem, there is no defined math formula. As we said earlier, opportunity cost is the value of the forgone alternative. The value can be measured in time, money, and satisfaction. Therefore, there is a mathematical way to think of opportunity costs.

A simple way to calculate opportunity cost is to find the ratio of what you are giving up to what you are gaining. When you think of opportunity cost in this manner, everything becomes easy.

Opportunity Cost = What You Give Up / What You Gain

In the world of business, the concept of opportunity cost applies in various processes. Entrepreneurs can think of opportunity cost in this manner:

Opportunity Cost = Revenue – Economic Profit

To understand opportunity cost in the business world, you need to know what economic profit is. Economic profit is the money that a business makes after deducting both implicit and explicit costs. The idea is that business needs to generate revenue over opportunity costs to grow and thrive.

If an organization cannot earn an economic profit, it will eventually fail. The business owner will have to leave the business and the available resources will be put to other uses.

For the majority of people, it makes sense to think of opportunity cost from the aspect of sacrificing and gaining. You should use opportunity cost when making decisions, especially the important ones.

Using opportunity cost calculations will allow you to determine what is valuable and identify the returns of the forgone alternative. As an entrepreneur, you should use opportunity costs to make decisions that will positively impact your business and increase returns.

How to Implement the Concept of Opportunity Cost?

As you have seen, most situations in life revolve around opportunity cost. Every time you make a choice, you automatically lose other alternatives that you could have chosen. This is how you create priorities that influence your decision-making process.

Opportunity cost does not always revolve around money. We make sacrifices for things that have no physical price. Research studies have shown that people make decisions based on their emotions.[3]

There are lots of hidden costs that opportunities can have, and every decision has a cost. The cost could either be direct or indirect. For instance, you can choose working more over spending time with your family. You may make more money, but that will probably cost a fulfilling family relationship.

What You Can Do Now

Think about one thing that you bought recently. How would you spend the same amount of money if you didn’t buy that? That’s the opportunity cost.

Conclusion

As you have seen, every action you’ll take has an opportunity cost. You should always compare every economic opportunity and choose the option with minimal costs. However, when making personal decisions, things might not be straightforward.

Opportunities can have similar costs due to emotional or personal reasons. In such instances, having a clear attitude and using the tips that we’ve covered here will help you make the right decisions and boost your productivity.

Featured photo credit: Kelly Sikkema via unsplash.com

Reference

| [1] | ^ | Investopedia: Why Are the Factors of Production Important to Economic Growth? |

| [2] | ^ | Sage Journals: Measuring economic growth using production possibility frontier under Harrod neutrality |

| [3] | ^ | National Library of Medicine: Socioemotional Influences on Decision Making: The Challenge of Choice |

function footnote_expand_reference_container() { jQuery(“#footnote_references_container”).show(); jQuery(“#footnote_reference_container_collapse_button”).text(“-“); } function footnote_collapse_reference_container() { jQuery(“#footnote_references_container”).hide(); jQuery(“#footnote_reference_container_collapse_button”).text(“+”); } function footnote_expand_collapse_reference_container() { if (jQuery(“#footnote_references_container”).is(“:hidden”)) { footnote_expand_reference_container(); } else { footnote_collapse_reference_container(); } } function footnote_moveToAnchor(p_str_TargetID) { footnote_expand_reference_container(); var l_obj_Target = jQuery(“#” + p_str_TargetID); if(l_obj_Target.length) { jQuery(‘html, body’).animate({ scrollTop: l_obj_Target.offset().top – window.innerHeight/2 }, 1000); } }

The post What Is Opportunity Cost And How to Calculate It? appeared first on Lifehack.